| 1. Balance Checker Report | |

| 2. Interest Checker Report | |

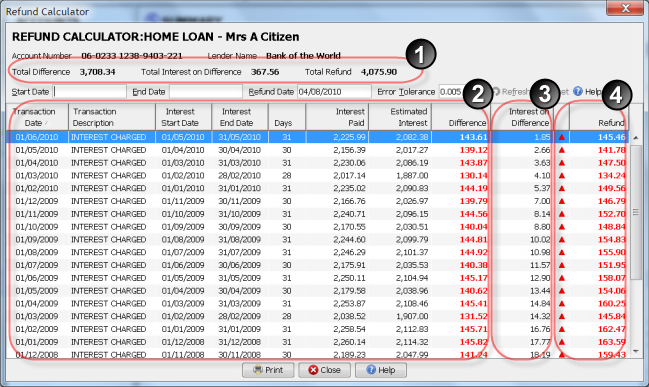

| 3. Refund Calculator Report | |

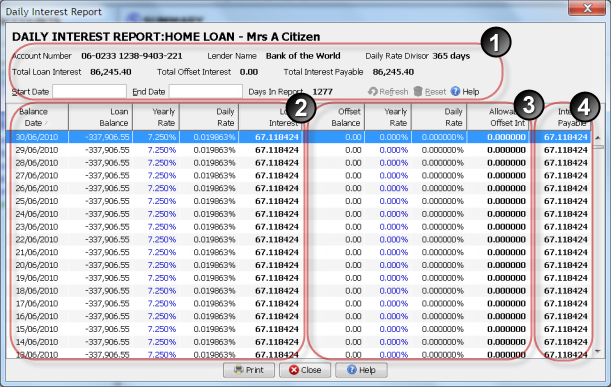

| 4. Daily Interest Report | |

| < Back to main report menu |

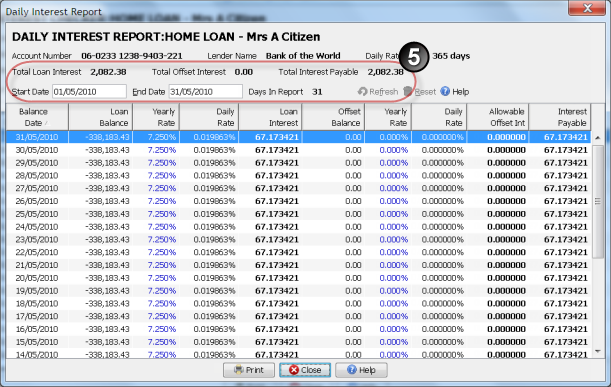

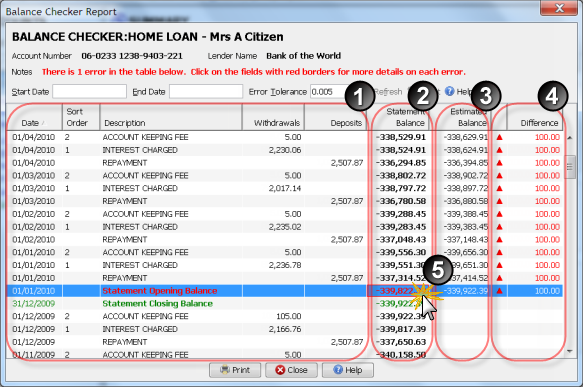

The balance checker report is designed to quickly highlight errors in the balances of a loan. It checks that the statement opening balance, the sum of the transactions, and the closing balance are correct from statement to statement. It also checks that the statement date ranges include all the transactions. If there is an error it will show you the calculated balance, the difference between the balances and the impact this error is having on the remainder of the statement.

Tip - The balance checker is also a great way to list ALL the transactions in a loan in the one place.

The report shows:

If you find errors in your balances, (5) click on the error for more information. (6) A window will open with an explanation of the problem, a list of most common reasons for the error, and what to do to fix it.

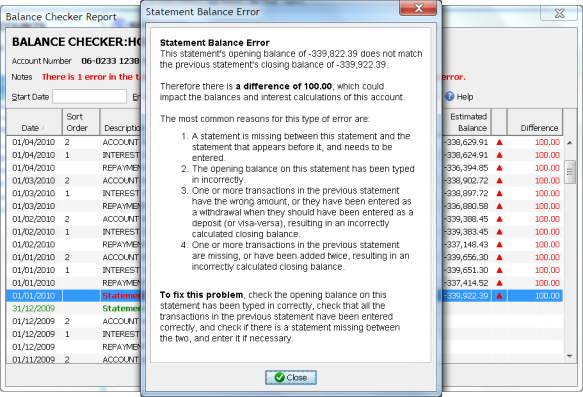

Shortcut - Editing Transactions

If you need to change a transaction, you can Edit Transactions directly from the Balance Checker Report by (7) double-clicking on the transaction you wish to edit. Any changes you make to transactions will instantly be reflected in the report.

If you only wish to change the transaction sort order then you can change it in the Balance Checker Report by (8) clicking on the sort order column (and a drop down list will appear). Any changes to the sort order will instantly be reflected in the report.

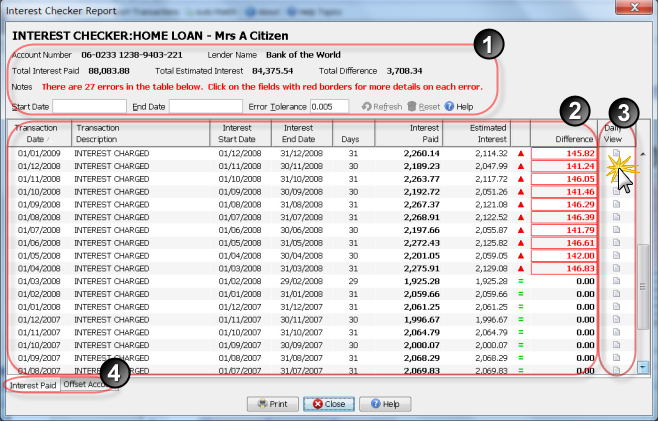

The interest checker report is designed to quickly highlight errors in the interest charges of your loans. It recalculates all the interest on the loan (including any offset account benefits) and compares it to the amount charged by your lender.

Tip - If the report is displaying any errors then the Interest Calculations help topic is the best place to start.

The report displays the following information:

Tip - This report will only show transactions that have been assigned the category "INTEREST - Periodic Interest". Therefore if you can't see all of your interest transactions, close the report, switch to the Transaction View and check the category you have assigned to each interest transaction.

Information Displayed in the Report

The main section of the report (the Interest Paid tab) shows the following information:

The offset account section of the report (click on the Offset Account tab) has two additional columns:

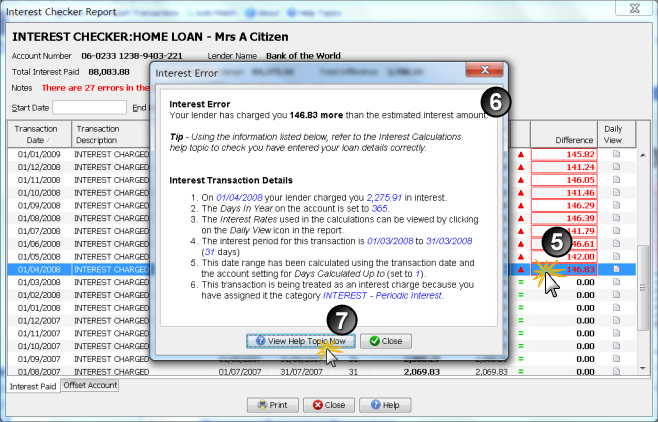

Interest Transaction Details

If you want to know more about the interest calculations, or you find errors in your interest charges, (5) click on the Difference column and (6) a window will open with an explanation as to how the software calculated the interest. (7) Click on the View Help Topic Now button and use the information provided to help resolve any differences in the calcualtions.

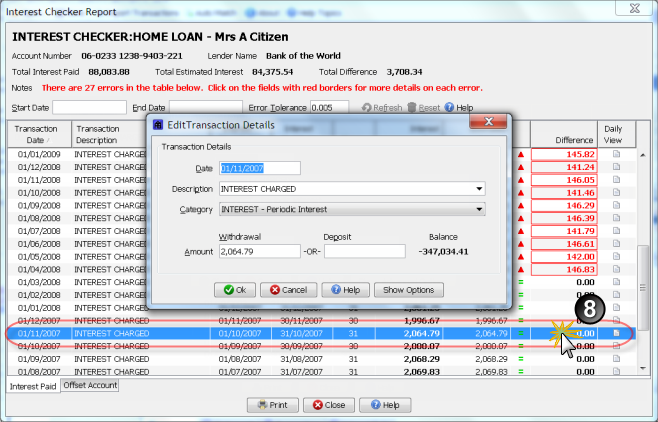

Shortcut - Editing Transactions

If you need to change a transaction, you can Edit Transactions directly from the Interest Checker Report by double-clicking on the transaction you wish to edit. Any changes you make to transactions will instantly be reflected in the report.

The refund calculator report is designed to calculate the total cost of the interest errors on your loans. If an error happened some time ago you will have been charged additional interest on the error, and the refund amount could be considerably more than just the original error amount. The refund calculator does all the complex calculations for you, taking into account interest rate changes, compounding interest on interest, manual adjustments, and all offset account benefits from the date of the error to the refund date.

Tip - This report will only show interest transactions that were displayed in the Interest Checker report with an error amount greater than the Error Tolerance value shown on this report. Therefore if this report is not showing any errors, switch to the Interest Checker report and double check if there are any errors being reported on your interest transactions.

The report shows:

The Refund Date field (5) allows you specify the end date for calculating the compounded cost of each error. When you first run the report the date defaults to today's date, however you can change it to any date that you require. A date earlier than today will result in a smaller refund, a date in the future will result in a larger refund.

The Error Tolerance field (6) allows you to control the minimum refund amount to be displayed in the report. Interest transactions with an error less than the tolerance amount you specify will not be displayed. For example, if you don't want to report on refunds less than $1 then set the error tolerance to 1.0 and click on the Refresh button.

Top of page

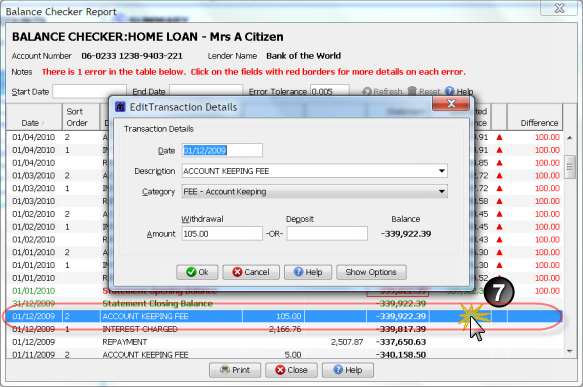

The daily interest report provides a day-by-day breakdown of the interest payable on a loan, and includes any offset account benefits you are entitled to. The report provides you with all the details you need to perform thorough audits of your loans and it allows you to investigate discrepancies reported in the Interest Checker report.

Tip - By default the report show every day in the account from the start date of the first statement, to the end date of the last statement. To view the report for a single interest transaction click on the Daily View icon from within the interest checker report.

The report shows:

Investigating Interest Errors

If you find a discrepancy between the interest being charged by your lender, and the estimates being calculated by Home Loan Manager Pro, you can use the daily interest report to review the day-by-day interest charges that make up the estimate. The report will also show you the interest rate that has been applied on each day.

From the interest checker report click on the Daily View icon for the interest charge you wish to investigate and (5) the daily interest report will be pre-populated with the correct date range.